Empower Financial Well-Being with our Smart Credit Counseling Software

Revolutionizing Housing & Credit Counseling Services

Harness the Power of the Best Housing and Credit Counseling Software

In today’s fast-paced funding and regulatory environment, counseling agencies require a software solution that is as dynamic as the market itself. CaseXellence delivers just that with the best counseling software, designed to streamline your operations and enhance client outcomes. Modernize your arsenal of tools and say goodbye to antiquated counseling software. Our platform is the cornerstone for agencies seeking to elevate their counseling through innovation and efficiency.

Key Features

Key Features of the Credit and Housing Counseling Software

Intuitive Client Management

Organize your clients and cases with our user-friendly cloud-based interface anywhere the internet is available

Connect with New Clients

Accept client interest by web form, over the telephone, in person, or by referral, manage client interest pipelines, and conduct scheduled or on-demand counseling

Credit Report Data

Automatically import credit report data, ensuring your counselors have accurate information and minimizing data entry

Manage Documents

Accept client documents online or scan and upload, check documents for completeness, automatically generate and print or send client documents online, or by mail

Compliance is Key

Meet state and federal compliance requirements with robust disclosure and agreement generation, self-edit document template capabilities as compliance needs change

Auditing

Ensure files and cases are complete with system-driven checks, self-audit capabilities, and built-in quality assurance review workflows to help support compliance requirements

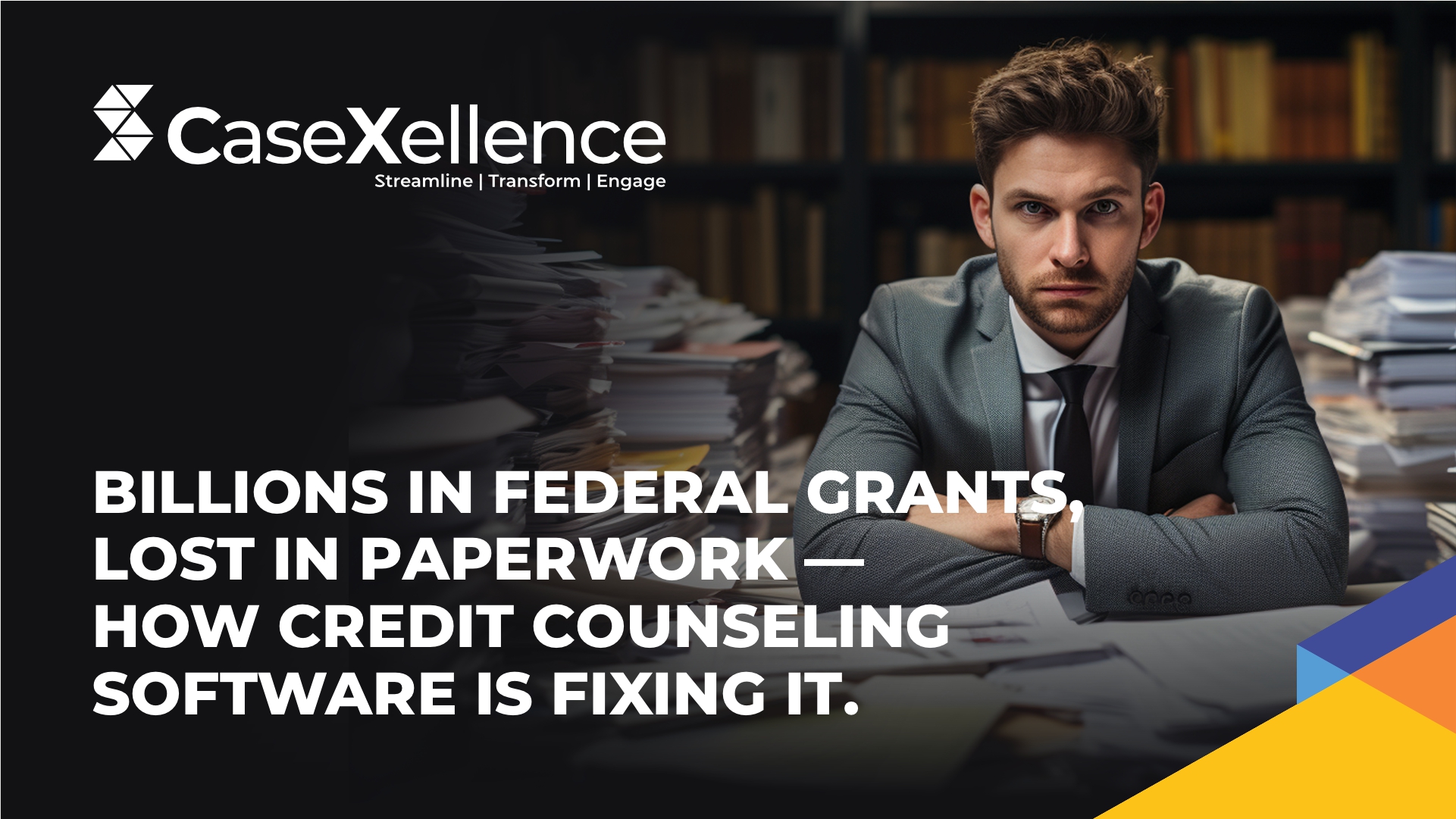

Grant Tracking

Meet grant requirements by tracking counseling and education activities, supported by robust grant reporting, including HUD’s 9902 report

Capture Education Efforts

Record and track housing and financial education courses, including measuring post-education results

Automated Workflow Processes

Increase your agency’s productivity with automation that simplifies complex tasks, from payment processing to appointment scheduling.

Secure Data Protection

Our software ensures the utmost security for your clients’ sensitive information, giving both you and your clients peace of mind.

Customizable Financial Tools

Tailor financial assessments and debt management plans with versatile tools that adapt to each client’s unique financial landscape.

Client Education Resources

Empower your clients with knowledge using built-in educational materials that complement your counseling services.

Benefits

The Impact of the Credit Counseling Software

Streamlined Agency Operations

The intuitive client management system and automated workflow processes significantly reduce administrative burdens, allowing your team to focus on core counseling activities instead of getting bogged down by paperwork and manual tasks.

Enhanced Client Satisfaction and Retention

A user-friendly interface and personalized service capabilities directly contribute to a better client experience. Satisfied clients are more likely to continue using your services and recommend your agency to others.

Reputation for Security and Reliability

By ensuring the highest standards of data protection, your agency gains a reputation for reliability and trustworthiness. This is crucial for attracting and retaining clients who are increasingly concerned about the security of their personal information.

Competitive Edge in the Market

The ability to provide customized financial tools and resources gives your agency a competitive advantage. Being able to cater to each client’s unique financial situation positions your agency as a versatile and client-focused entity in the market.

Knowledge Empowerment as a Service Differentiator

Providing clients with educational resources not only helps them make informed decisions but also elevates your agency’s profile as a holistic service provider, going beyond just counseling to empower clients.

Scalability and Future-Proofing

The software’s adaptability to changing market conditions and scalability to match your agency’s growth ensures that you are investing in a future-proof solution.

Related Blogs

What is a Credit Counseling Program? Exploring the Best Housing and Credit Counseling Platforms for Agencies

Credit counseling programs are structured to provide individuals with the guidance and tools necessary to manage debt, improve credit, and make informed financial decisions.

The Role of AI and Automation in Credit Counseling Platforms

Credit counseling platforms have become crucial for individuals seeking financial health, debt management, and credit score improvement. The advent of AI and automation is transforming these platforms, making credit counseling software more efficient.

How Does Credit Counseling Software Support Funding and Grant Management?

In today’s economic climate, managing debt and maintaining financial stability can be challenging for many individuals.

Reinvent Housing and Credit Counseling With

FAMS CX!

By integrating CaseXellence’s counseling software into your agency’s arsenal, you have the modern tools to impact your clients’ lives and be at the forefront of counseling and client service excellence. Let’s redefine what it means to provide outstanding housing and credit counseling together